Economics: Taxation

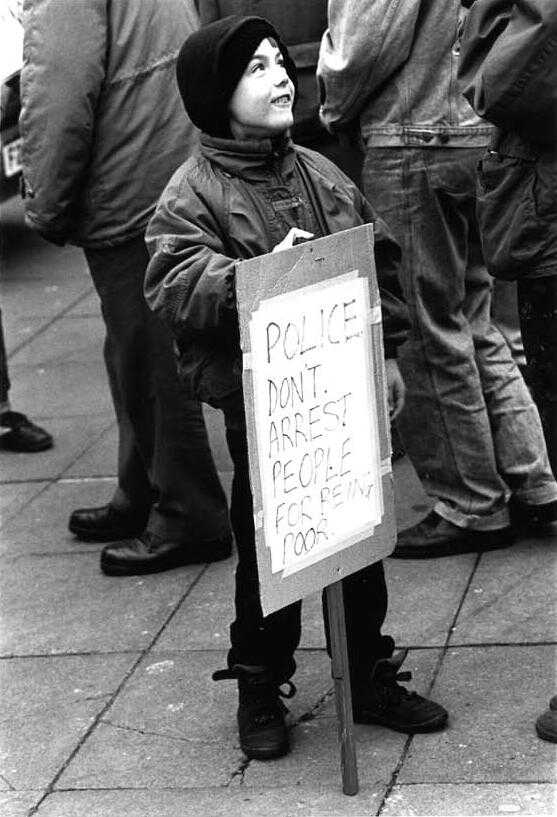

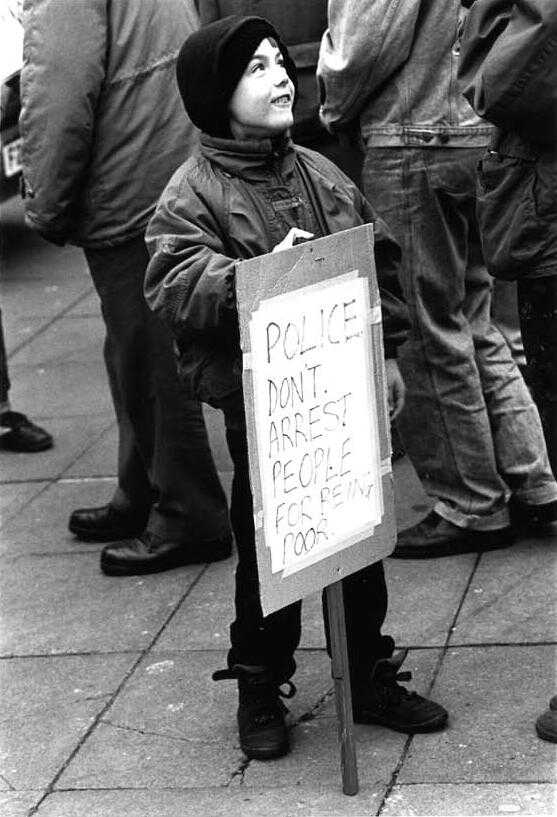

Figure 1.--Herec we see a British press photo of a London boy protester duting 1992. The heading was "Anti Poll tax demonstration". The cation read, "The Community Charge known as the Poll tax is a head tax for each individual residing in England at present. There is rising resentment for this unfair system where affluent people pay the same as those without means. The police have the unenvious task of enforcing the court’s decision to jail poll tax defaulters. “POLICE DON’T ARREST PEOPLE FOR BEING POOR” – message held by the boy." The image is an emotional one highlighting equity and morality. Often loss in the highly subjective debate on equity and mprality is the consideration of effectiveness, how to maximize revenue collection without retarding economic activity.

|

|

A major issue in state with a capatalist economy is taxation. Tghere are three basic types of economies: socialist (state onership), capatlist/free enterprise, and mixed economies (partial state onership). Taxation is not an issue in a socialist state because the government owning the means of production can generate revenue from the operations of state controlled enterprises. The problem for the citizens of these socialist or largely socialist countries (Cuba, North Korea, and Viet Nam) is that state operations are so ineficient that the economy is not productive and thus the people are among the poorest in the world. The inefficies of socialist economics led to the collaspse of the Dociet Union and the decesion of socialist countries (like China) to adopt free market reforms. Taxation is an issue in a free market economy because the state has no way to generated recenue except to tax. Historically the two most capatalist countries have been Britain and America and their economic success since the 17th century has been largely due to the ecomomoic sucess generated by market capitalism. They also until the Depression of the 1930s have been the countries with the lowest tax burden. American officials from an early point recognized that the power to tax was the power to kill, a doctine enunciated by the Supreme Court at an early point in the Republic. Political liberalism was founded in Europe on the idea of restriction state intrusions in economic life. The state at the time was cdominated by aristocrats or individuals enriched by state action and refressive European tax systems reflected this. American tax tax revenue was at first generated by tariff revenue. State revenue systems was more varied. As the United States industrialized abd during the crisis of the Civil War, other forms of revune were needed. There are a range of different taxes, but they can be either regressive or progressive taxes. A regressive tax affects all tax payers equally. A progressive tax imposes a higher tax burden to those with higer incomes. The progressive movement strongly promoted a progressive tax system. The idea of a progressive tax system in generally accepted in democratic nations. The basic question is what level to set the tax rate. Here there are two basic concerns. First is equity. While there is differences of opinion here, the basic principle is that the wealthy who benefit most from society should pay more. Second is effectiveness. And here there are two matters to consider. One is the law of diminidhing returns. There is a point beyond which highrr rates will actially retuen less revenue because payer will avoid them. Two, thre is also a ate beyond which will retard economic activity, reducing both government revenue and the wages of the lower income people the progressive income tax was susposped to benefit. Notice that equity is a value judgement and highly subjective. Effectiveness is not subjective and can be meaured imperically.

Sources

CIH

Navigate the Children in History Website:

[Return to the Main market capitalism page ]

[Return to the Main modern industrial era economics ]

[Return to the Main Economics Page ]

[Introduction]

[Animals]

[Biographies]

[Chronology]

[Climatology]

[Clothing]

[Disease and Health]

[Economics]

[Geography]

[History]

[Human Nature]

[Law]

[Nationalism]

[Presidents]

[Religion]

[Royalty]

[Science]

[Social Class]

[Bibliographies]

[Contributions]

[FAQs]

[Glossaries]

[Images]

[Links]

[Registration]

[Tools]

[Children in History Home]

Created: 1:33 AM 8/18/2009

Last updated: 4:31 AM 11/4/2014